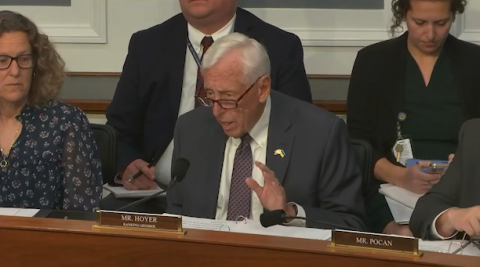

Ranking Member Hoyer Opening Remarks at FSGG Hearing on the U.S. Securities and Exchange Commission

Click here to watch a full video of his remarks.

“Today's hearing on the Securities Exchange Commission comes amid circumstances somewhat reminiscent of the time of the agency's founding. Though not as dire as the Great Depression, there's a significant volatility and lack of confidence in our markets right now. The Trump Administration's tariffs shocked the stock market and rattled U.S bonds. The value of the dollar is down around the world, [which] could be good or bad in some instances. In the past quarter, our economy shrank for the first time since the Covid 19 crisis. In April, consumer sentiment slid to its second lowest reading on record, with Americans rightfully fearing what rising costs from tariffs will mean for their finances and their families. Trump's trade agenda paired with Republicans' efforts to explode the national debt by passing massive tax cuts for the wealthiest among us, let America lose its last perfect credit rating just last weekend. There are also growing concerns of market manipulation and insider trading related to Trump's tariff pause announcement. When he said it was a good time to buy, it turned out to be a good time to buy, as he announced just hours later he was going to change his trade policy. Today's circumstances may be similar as the SEC’s funding, but I fear the agency’s response may not be.

“The SEC ought to address the current mistrust and fraud in our markets by better protecting investors and improving enforcement. I had the opportunity to read your testimony, and I thought it was comprehensive and good. On page three, you said, ‘policy making will be done through notice and comment rulemaking, not through regulation by enforcement.’ I think I understand what you mean by that, but I also am concerned as to the reduction that we have seen in enforcement monies. I'm going to – I'll ask you questions about that. The SEC, in my view, ought to address the mistrust and fraud in markets by better protecting investors and improving enforcement, not reducing it.

“I'm concerned by the reports that the SEC has lost between 15% and 19% of its staff, including large reductions to its legal affairs, investment management, and trading and market divisions because of DOGE purge. Those cuts don't save the taxpayer any money since SEC is entirely fee funded. Although, as I understand your testimony, you may clarify that, we're now down to zero per million because the budget is already paid for in the first five months, is that what I read correctly in your statement? These reductions will, however, make it harder for the SEC to enforce laws and regulations that keep our markets fair, orderly, and efficient, an absolutely essential part of your work. Since Trump took office, the SEC has sought to dismiss numerous enforcement actions, including many with direct or indirect implications for Trump's family’s or his own best financial interests. Chairman Atkins, I understand that many of these changes were put into motion before you started your role a few weeks ago, although you were complimentary of those efforts in your statement. Many Americans share my concern that this overhaul weakens the SEC [and] by extension, our markets. We need to ensure, as you have said, you want to do it and as I believe you do want to do [and] SEC can do the job it was created to do to restore confidence in our markets, to go after insider trading and corruption, and to protect American investors.

“I look forward to working together with you to accomplish those objectives on behalf of the American people and our economy. Thank you, Mr. Chairman.”