Hoyer Opening Remarks During Briefing on Trump Administration's Cuts to the Internal Revenue Service with Former IRS Commissioners

WASHINGTON, DC – Today, Congressman Steny H. Hoyer (MD-05) delivered opening remarks at a briefing on the consequences of the Trump Administration's cuts to the Internal Revenue Service (IRS). Below is a video of the full briefing and a transcript of his opening remarks:

Click here to watch a full video of the briefing.

"This shadow hearing — or briefing — is called because of my great concern about what is happening at IRS, my great concern of what's happening in Treasury generally. Beyond that, my general concern as to what is being done to undermine the effectiveness and responsiveness of the federal government to and for the people. I talked to Richie Neal, who's a relatively short-timer for this place for, I think, for 5 years and who has become of my close friends over the years, and Mike Thompson will be coming as well and Don Beyer who's on the IRS Subcommittee in Ways and Means is here as well. Mark Pocan and Sanford Bishop, we expect the others who are named, who have said they would be here. Hopefully they will be. There's a lot going on, as you know, much of which is not very good.

"But it's my premise that the IRS is underfunded, understaffed, and underappreciated. The good news is -- not underappreciated by the lady who's coming in the room who is the Chairman of the Appropriations Committee [Rep. Rosa DeLauro]. Tom Suozzi is now coming in the room who is a member of the Ways and Means Committee and a member of the IRS Subcommittee.

"So, this is an unusual hearing. I got this idea really from Chair DeLauro, who had a similar hearing on education subjects and children's subjects not too long ago. I asked the Chair of the Committee — Chairman of the Subcommittee of which I serve, the Financial Services and General Government Committee, to have a hearing and have the IRS Commissioner present. It was an acting IRS Commissioner who is also the Deputy Secretary, as I think most of you know. And frankly, I say as an aside, with the new IRS Commissioner, it may have been an entertaining hearing, a little long, very funny. But I thought it was absolutely essential for us to have a better knowledge of what we're doing. My conviction is, Musk and DOGE knew how to do it, they knew nothing about the consequences. I'm not talking just an IRS or Treasury, I'm talking across the board. So, I talked to Richie Neal, and I talked to my Chair, DeLauro, and to Mike Thompson and they all agreed that this was something that we needed to do to inform the public. Now, I showed all of you, this is, I think, the first hearing — I've been here 44 years. This is the first hearing where I've read every word of all of your testimonies. And I think it's extraordinarily instructive. Let me make a few brief remarks, and then, we're going to get underway, because this is not a hearing in the formal sense. I just wanted to set parameters. Ms. DeLauro, obviously, wants to say something briefly at the beginning, and Mr. Neal does. He'll be here about 20 minutes later, he said.

"I want to thank all of you for being here. Members, you will be impressed not only with the verbal testimony, but you ought to take as a primer course on what we're doing on IRS and Treasury, and read, as I have, this testimony because everybody at this table spent time preparing testimony, knowing full well this is not — I want to tell everybody we are going to have a video recording of this. We're not going to have a direct record at first, but everything you say will be recorded. The reason is, I want that preserved so that we can give that or show that to other members.

"Our Republican colleagues have been reluctant to hold public hearings on the Trump Administration's assault on the IRS, so we decided to host our own briefing. The American people deserve answers, and we hope to provide them with some today. And I wanted this to be the authorizers, who think they're the most important, and the appropriators, who clearly know we're the most important. So, there's not full agreement on that question, but there's full agreement that we need to make sure we get IRS right. We believe in fiscal responsibility. A number of you mentioned the debt in your comments and what we have to do to address that. We know that fiscal responsibility certainly involves looking at spending, but also, crucially, at revenue.

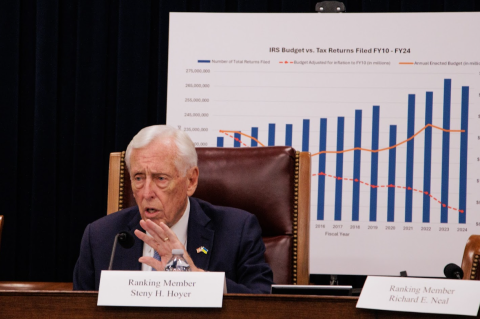

"For years, the IRS has been desperately underfunded and understaffed, leaving hundreds of billions of dollars in legally-owed taxes uncollected. And therefore, placing more of a burden on those taxpayers who do fully comply. Ms. Olson, you made that comment a number of times, as did I. (Gestures toward poster on an easel) Now, this graph shows how we have in effect tanked enforcement, particularly on the wealthy. Filers have gone way up, and the budget has gone way down. And this is, if you're over a million dollars, you've gone from an approximately nine percent chance of being audited to six tenths of a percent. While 85 plus percent of our filers paid their taxes every week, every bi-week, or every month. And they are almost 100% compliant. All of you know that, I just say that for whatever record will ultimately be brought. As this graph shows — I told you what it shows — the agency has more work and fewer resources to do it. (Gestures toward poster on an easel) That's on this graph. Again, the budget, and this is the real budget if you count for inflation. That's what's happened to the budget.

"Though annual IRS appropriations have nominally stayed even, in reality, they have not. And I want to call everybody's attention here to page four of Ms. Olson's testimony, in which she points out that taxpayer services in this budget, counting for the [Inflation Reduction Act (IRA)] expectation, and one of you mentioned the necessity for a longer term, at least three years. I don't remember which one of you, I just, I read it, sustained spending. Taxpayer services have been down 7.4%. Enforcement services down 45.9% — cut in half to what the IRA provided. Technology and operations, which they claim is going to solve the problem, 58.2% down in actual funding. Overall, a 44% reduction in IRS's resources, both in staff and in money. In 2010, the IRS examination rate appeal, I told you, 1 million more was near 9%, now down [to] 0.6% percent. In Fiscal Year 2022, that figure ticked up to 1%. There was a new administration, and there was a little bit of an increase. But not where it needs to be. Even still, an estimated $606 billion. Now, very frankly, we have anywhere from $200 billion at a very low end to a significantly higher figure than $600 billion in legally owed taxes, which go uncollected every year.

"Now, as I point out all the time, I know Mike, you do, Rosa I'm sure, and the members of the committee, we keep spending. Somebody's got to pay that bill, and you pay that bill either in interest — which is now about a trillion dollars more than we spend on our national security — so that if the people who owe don't pay, the people who we voluntarily take money [from] pay more. I say involuntarily, they have to pay it, in that sense; we pay our taxes because it's withdrawn from our wages. IRS data suggests that every $1 dollar invested in enforcement yields $7 of revenue in return. Your testimony will reflect that is perhaps an average, but it can go as high as $12 or more, depending upon the level of taxpayers' income.

"Crucially, research from Harvard and the Treasury Accounts found that when it's targeted at the top 10% earners, $1 gets you $12 back. There's nobody in the Congress of the United States who wouldn't make that kind of investment, except in IRS. That yield is so high in part because of the deterrent effect, (gestures to witness table) which you speak to, and you speak to as well, and the two of you. Everybody probably speaks to that. The problem with reading all five [testimonies], I don't have them absolutely catalogued in my brain. Democrats took action to address this issue. The Yale budget estimated that the $80 billion we include in the Inflation Reduction Act for the IRS would have led to a net increase in revenue of $637 billion over the next decade. And that, I think, is at the low side.

"Republicans, however, sought to undo this progress at this turn. This hearing is not about going after the Trump Administration or going after Republicans. This hearing is to get information so that we can be well informed and explain to them and to the American people what we're leaving on the table that is owed, no tax increases. Trump's recent purge of nonpartisan federal employees has also badly hurt the IRS. Now there's some in, some out, some came back, so we're not sure exactly where it's going to land, but we'll see what the courts do, and we'll see what the administration does, and see what Secretary Bessent does. Yale Budget Lab, an extraordinary organization, headed up by Dr. Sarin. Yale Budget Lab estimates that doing so will lead to between $395 billion and $2.4 trillion in lost revenue over the next decade. To put that in perspective, the Senate Tax Budget and Trump's One Big, Beautiful Bill costs $4.2 trillion over the next decade. Evidently, it wasn't enough for Trump to lower taxes on the wealthy, they also want to make sure that no more than 0.6% of their returns — otherwise known as 99.4% of those who have over a million dollars, not having their taxes looked at all. What does that mean? I made the analogy that day in committee about, you see a cop on the side of the road, there's not one of us that doesn't automatically, just knee jerk, Pavlovian-like, lift our foot off the accelerator. Same thing's going to happen when you hear six tenths of a percent. I'll take that chance. All of this to a vital agency that's already desperately under-resourced. An attack on the IRS is an attack on America's fiscal health. As the Administration exploded the debt of the American people —and I say, 'this Administration,' we have all been responsible for exploding this debt. [We] just want to spend money on different things. And a tax expenditure is an expense.

"So, I thank all of you, and I thank the Members, and I yield quickly to Ms. DeLauro and then to Mr. Thompson."