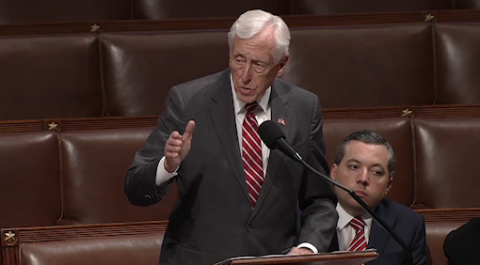

Hoyer Floor Remarks in Support of FY 2026 FSGG Appropriations Bill

WASHINGTON, DC – Today, Congressman Steny H. Hoyer (MD-05), Ranking Member of the Financial Services and General Government (FSGG) Appropriations Subcommittee, delivered remarks on the House Floor in support of the Fiscal Year 2026 FSGG Appropriations bill. Below are a video and transcript of his remarks:

Click here to watch a video of his remarks.

“I thank the former Chair and Ranking Member for yielding. I thank her for her work. I thank Mr. Cole for his work. Anybody who knows me knows that I am opposed to CRs, but I am for keeping the government open if those are the only alternatives. Mr. Speaker, this would not be my bill, but I think probably most of the Members on this Floor can say that. But it is a bill that cooperatively has been made better, I think, as it has passed through the House and the Senate in conference. It provides increases for several key programs for the American people; that includes a $13 million increase over the Fiscal Year 25 enacted level for entrepreneurial development programs at the Small Business Administration. The Ranking Member mentioned that program, but critically important to our communities and to the small business community. This bill also increases funding for elections security grants by $30 million. I created that program along with Bob Ney from Ohio when we passed the Help America Vote Act. We all want to make sure our elections are run well.

“At that point in time, we distributed to the states over $3 billion. This is $45 billion – $45 million for 50 states. Not a lot of money, but it is proper for the federal government to help pay for the elections that are run by the locals that include United States Senators and Members of Congress. The judiciary, Mr. Chairman, receives $584 million, or 6.2% increase over [Fiscal Year] 25 enacted, which is what they asked for. And the reason we wanted to do that is to make sure that the courts can act efficiently, effectively, and justly. We also included $142 million, or a 19% increase for court security. Unfortunately, and we see in our streets today, we are living in [an] era in which violence is too often [resorted] to. Crucially, the bill fixes the funding hole for federal public defender services – which are constitutionally required – providing an increase of $315 million, or 22%, over the [Fiscal Year] 25 enacted level to meet constitutional responsibilities. Other programs at the Department of Treasury, including the Community Development Financial Institutions [Fund], so critical for small communities and communities of little means, were flat funded in their Fiscal Year 25 enacted level instead of being eliminated. So, while it is not everything we would want, it is a vast improvement over what was requested.

“Even still, Mr. Speaker, some of my colleagues may notice my lack of enthusiasm for this final bill. This bill is $1 billion, or 9% cut to the Internal Revenue Service below the Fiscal Year 2025 enacted [level] is particularly concerning to me, and I made this point I think every time we consider this bill, and I might say that we tried to overcome this deficiency and have not yet done that. It includes a $438 million, or 8%, cut to enforcement. Now, what does cutting enforcement [mean]? It means that we have gone from 9% in looking at tax returns over $1 million to 6/10 of a percent. What incentive is that to people who make a lot of money and who try to avoid taxation? The little guy has to pick up the tab. Mr. Speaker, that cut will cost the American people dearly by making it easier for millionaires, billionaires, and corporations to avoid paying the taxes they owe under existing law. Nevertheless, this bill is better than what it otherwise would have been. IRS data indicates that every $1 produces $7. [A] Harvard study shows that for the top 10% every dollar invested in enforcement brings us $12 in additional revenue in taxes owed but not paid. Who will have to pick up the tab? As I said, hardworking Americans who dutifully pay their taxes. If you're serious about fiscal responsibility as I am and as I think many are – if you're serious, you have to be serious about collecting revenue that’s due in owing. That means funding the IRS, which has been understaffed and under-resourced [for] far too long.

“Now, I'm concerned not only by the IRS, but also the FBI. For two decades, I've worked to help the FBI move out of the crumbling, unhealthy J. Edgar Hoover building and into a new consolidated headquarters that meets its security and operational needs. The Administration has decided to move the FBI from [an] inadequate 51-year-old building to [an] inadequate 28- year-old building. The Reagan Building’s exposed location and its design as an accessible public-private facility would greatly undermine the FBI's security. I will continue to work on that throughout the year that I have remaining to me. There was language in the CJS bill that I wanted the Rules Committee to include the same exact language saying simply that we would oversee the plans of the GSA and the FBI before we spent money. That was the responsible thing to do. I'm sorry, Mr. Speaker, that we did not do it, but I am going to support this bill.”